Vaibhav and Vilas were partners sharing profit and losses in the ratio of 2: 3 respectively. Their Balance Sheet as on 31st March 2012 was as follows.

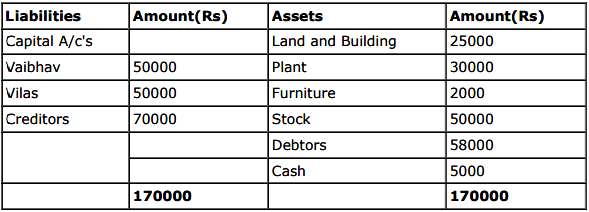

Balance Sheet as on 31st March 2012

They agreed to admit Vivek as a partner on 1st April 2012 on the following terms:

1) Vivek will have 1/4th share in future profits for which he shall bring Rs 25,000 as his capital and Rs 20,000 as his share of goodwill.

2) Land & Building are valued at Rs 30,000 and while stock is valued at Rs 55,000.

3) Plant is taken over by Vilas 10% discount.

4) Depreciate furniture by 10%.

5) Provision for bad and doubtful debts is to be maintained at 5% on debtors.

6) The capital account of all the partners to be adjusted in their new profit sharing ratio and excess amount to be transferred to their loan account.

Prepare Profit and Loss Adjustment Account, Partner's Capital Accounts and Balance Sheet of New Firm.