In the books of Partnership Firm

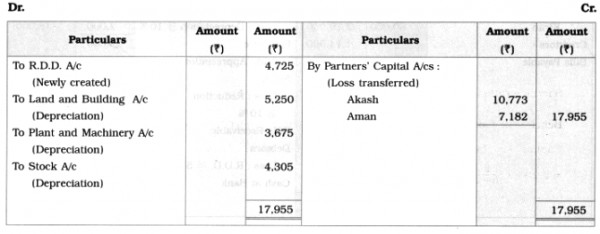

Revaluation Account

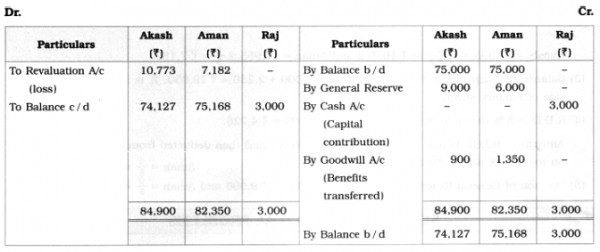

Partner's Current Accounts

Balance Sheet as of 1st April 2019

Working Notes:

1. Calculation of sacrifice ratio of old partners:

Old ratio: Akash = \(\frac{3}{5}\) and Aman = \(\frac{2}{5}\)

New ratio: Akash = \(\frac{2}{4}\) and Aman = \(\frac{1}{4}\)

Sacrifice ratio = Old ratio – New ratio

Akash’s sacrifice ratio = \(\frac{3}{5}-\frac{2}{4}=\frac{12-10}{20}=\frac{2}{20}\)

Aman’s sacrifice ratio = \(\frac{2}{5}-\frac{1}{4}=\frac{8-5}{20}=\frac{3}{20}\)

Sacrifice ratio of Akash and Aman = \(\frac{2}{20}:\frac{3}{30}\) i.e. 2 : 3.

Benefits of Goodwill of ₹ 2,250 distributed and transferred to Akash’s Capital A/c and Aman’s Capital A/c in their sacrifice ratio (which is 2 : 3).

Goodwill credited to Akash’s Capital = 2,250 × \(\frac{2}{3+2}\) = ₹ 900

and Aman’s Capital = 2,250 × \(\frac{3}{5}\) = ₹ 1,350.

2. Debit balance of Revaluation of ₹ 17,955 indicates Loss on revaluation.

Division of Revaluation Loss:

Akash = 17,955 × \(\frac{3}{3+2}\) = ₹ 10,773

and Aman = 17,955 × \(\frac{2}{5}\) = ₹ 7,182.

3. Balance in Cash A/c at the end = 13,800 + 3,000 + 2,250 = ₹ 19,050.

It is shown on the Assets side of the Balance sheet.

4. R.D.D. = 5 % on value of Debtors = \(\frac{5}{100}\) × 94,500 = ₹ 4,725.

Amount of R.D.D. is first debited to Revaluation A/c and then deducted from the value of Debtors on the Assets side of Balance Sheet.

5. Division of General Reserve:

Akash = \(\frac{3}{5}\) × 15,000 = ₹ 9,000

and Aman = \(\frac{2}{5}\) × 15,000 = ₹ 6,000.