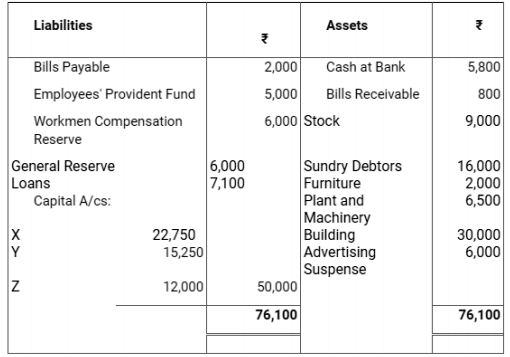

The Balance Sheet of X, Y and Z as at 31st March, 2018 was:

The profit-sharing ratio was 3 : 2 : 1. Z died on 31st July, 2018. The Partnership Deed provides that:

(a) Goodwill is to be calculated on the basis of three years purchase of the five years average profit. The profits were : 2017- 18: Rs. 24,000; 2016-15: Rs. 20,000; 2014-15: Rs. 10,000 and 2013-14: Rs. 5,000.

(b) The deceased partner to be given share of profits till the date of death on the basis of profits for the previous year.

(c) The Assets have been revalued as: Stock – Rs. 10,000; Debtors – Rs. 15,000; Furniture – Rs 1,500; Plant and Machinery – Rs. 5,000; Building – Rs. 35,000. A Bill Receivable for Rs. 600 was found worthless.

(d) A Sum of Rs. 12,233 was paid immediately to Z’s Executors and the balance to be paid in two equal annual installments together with interest @ 10% p.a. on the amount outstanding. Give journal entries and show the Z’s Executors Account till it is finally settled.